Swapping Guide

Trade tokens using Levr's integrated Uniswap V4 pools.

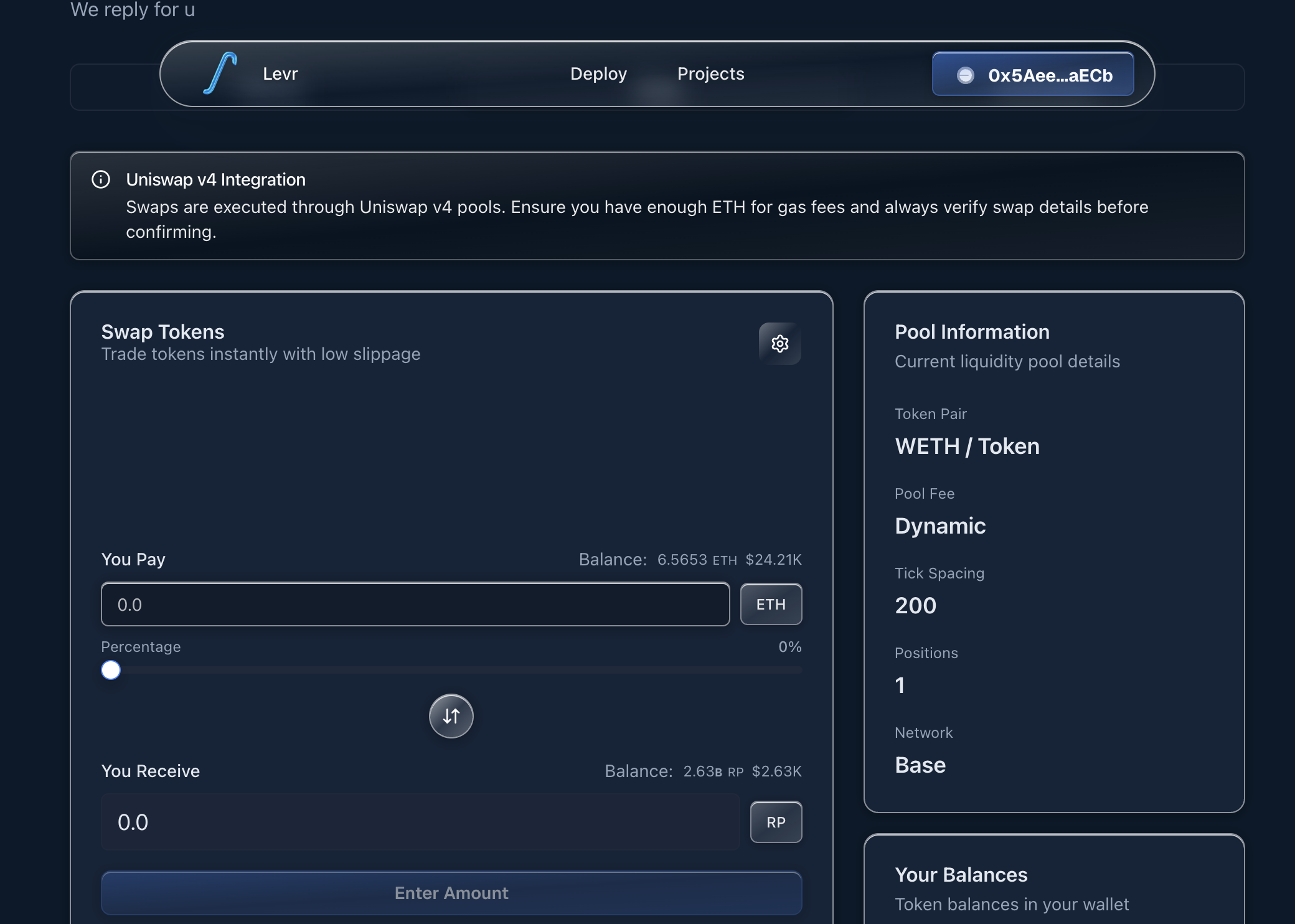

What You See

The swap interface shows:

Your Balances:

- Token balance

- ETH balance

- USD values (if available)

Swap Direction:

- Token → ETH (sell tokens)

- ETH → Token (buy tokens)

Quote:

- Amount you'll receive

- Price impact

- Fees breakdown

How It Works

Buy Tokens

1. Select ETH → Token

2. Enter ETH amount

3. See how many tokens you'll get

4. SwapSell Tokens

1. Select Token → ETH

2. Enter token amount

3. See how much ETH you'll get

4. SwapSwapping

1. Choose Direction

Click the direction toggle:

- Token → ETH - Sell tokens for ETH

- ETH → Token - Buy tokens with ETH

2. Enter Amount

Type how much to swap:

Selling: 1,000 tokens → Get ≈ 3.5 ETH

Buying: 5 ETH → Get ≈ 1,500 tokens3. Check Quote

Review before swapping:

Amount Out: 3.5 ETH

Price: 1 token = 0.0035 ETH

Price Impact: 0.5%

Fees: 0.3% + hook feesPrice Impact

- < 1% - Excellent

- 1-3% - Good

- 3-5% - High (consider reducing amount)

- > 5% - Very high (split into smaller swaps)

4. Approve (First Time)

First-time swaps need approval:

Click Approve → One-time approval per token

5. Swap

Click Swap → Confirm transaction → Tokens swapped

Understanding Fees

Every swap has fees:

Trading Fee: 0.3% (standard Uniswap)

Hook Fees: Small additional fees

- Static: Fixed percentage

- Dynamic: Adjusts with volatility

Total: Usually 0.3-0.4% combined

All fees shown in quote before you swap.

Price Impact

Price impact is how your trade affects the pool price.

Why it happens: Larger trades move the price more in smaller pools.

How to minimize:

- Trade smaller amounts

- Split large trades

- Wait for more liquidity

When it's too high: If impact > 5%, consider:

- Reducing swap amount

- Splitting into multiple swaps

- Accepting the impact if urgent

Slippage Protection

Slippage protects you from price changes:

Expected: 3.5 ETH

Minimum (1% slippage): 3.465 ETH

If you get less than 3.465 ETH → Transaction revertsDefault: 1% slippage (recommended)

Adjust if:

- Swap fails → Increase slippage

- Volatile market → Use 2-3%

- Stable market → Use 0.5%

Tips

For Buying:

- Check price impact first

- Start small to test

- Consider dollar-cost averaging

For Selling:

- Same checks apply

- Consider selling in portions

- Watch for high impact

General:

- Always verify amounts

- Check fees in quote

- Save transaction hash

Common Questions

Why is price impact high? Your trade size is large relative to the pool. Reduce amount or split into multiple swaps.

What's the difference between trading fee and hook fees? Trading fee (0.3%) goes to the pool. Hook fees go to fee receivers (including staking).

Can I swap without ETH? You need ETH for gas fees. The swap itself uses tokens or ETH depending on direction.

What if the transaction fails? Usually means price moved beyond slippage. Try again with higher slippage.

Is there a minimum/maximum swap? No hard limits, but very small swaps waste gas and very large swaps have high price impact.

Where do the fees go? Trading fees → Liquidity providers and stakers. Check the project's fee configuration.